Everything You Need To Know About Chime (Detailed Overview)

So, what is Chime?

Chime Financial, Inc. is an American financial technology company. The company is famous for providing fee-free mobile banking services. Most of the services are provided by Stride Bank or Bancorp Bank. If you have an account, then there are credit cards and debit cards for you as well to get access to the online banking system.

There is also a mobile application that you can use to access your account and other features. Also, the company website is there for everyone to use. The revenue model of the Chime comes from the interchange fees that the platform charges.

Company Overview

Here is the basic information about Chime.

Company Profile

| Company Name | Chime |

| Founded | 2012 |

| Founders | Chris Britt Ryan King |

| Industry | Financial Services |

| Type | Private |

| Headquarters | San Francisco, California, United States |

| Key People | CEO- Chris Britt CTO- Ryan King |

| Area Served | Worldwide |

| Products | Checking Accounts Debit Cards Saving Accounts P2P Fee-free Overdraft Credit Cards |

| Employee Number | 1,300 |

| Revenue | $1300 million (2023) |

| Website | chime.com |

Company History

Chris Britt and Ryan King founded Chime in 2012. The company started in San Francisco, California. The company came publicly in 2014 through the Dr. Phil Show. In 2020, the company raised a fund of $1.5 billion. The focus of the company was to create an alternative to traditional banking. In 2018, the company acquired a startup that was focused on creating financial peace of mind.

The company aims to help young adults and millennials. There are also credit bureaus and rent payments as well. Also, Pinch’s co-founder was hired into the team, and this was a part of the acquisition. There were other service outages as well that the company faced in 2019. But the issues were resolved only within a day.

The company made a partnership with the Dallas Mavericks in 2020. The deal was about sponsoring jerseys, and it was a multi-year deal. In the same year, the company had to face COVID-19, and for that, the company announced a pilot program for providing tax solutions. They used to use SpotMe, which was a stimulus payment. After this, the company enhanced the payment method. Then the company announced its fee-free overdraft products as well.

It was the time when Chime announced that it successfully processed $375,000,000 in stimulus payments. In 2022, the company released its IPO. But it was late to launch its IPO. Recently, the company has been in controversy as it has terminated 12% of its employees.

When it comes to funding, in the series G funding round, the company got $750 million. The main investor of the company is Sequoia Capital. And the valuation of the company increased to $25 billion last year.

Product

First of all, the company provides fee-free banking products. There are savings features which is automated, and there is also a feature where there is no minimum balance at all. One of the best features is that there is also early wage access.

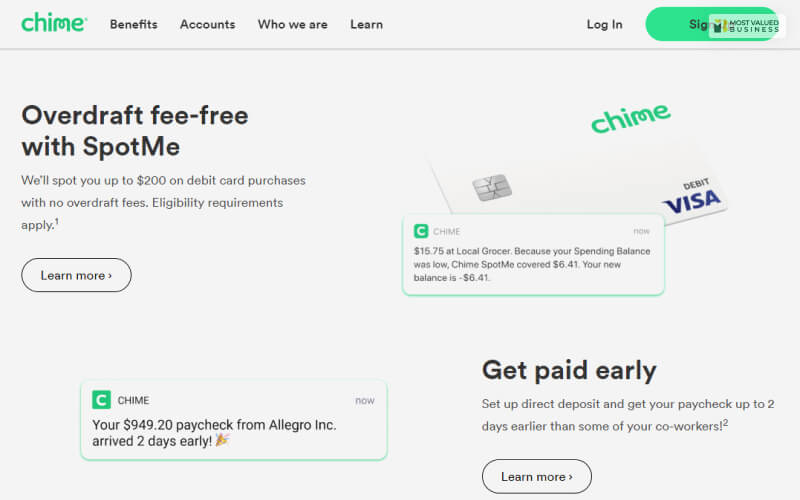

A couple of years ago, the company launched SpotMe. This was a fee-free service where customers could get great deals. Suppose you open an account, then you can overdraw $100, and you don’t need any overdraft fee. If the limit is reached, then every purchase will be declined. Also, you don’t need to pay any negative balance fees.

In 2020, the company launched another feature called Credit Builder. This was basically a credit card, and through this, you can build your credit history.

Chime, Is It A Bank?

First of all, Chime is not a bank. Chime has two agreements with the Illinois Department of Financial and Professional Regulation and the California Department of Financial Protection and Innovation. And it stopped representing this company as a bank.

The company agreed on a term where it would stop using the URL. There are also disclaimers regarding product text and marketing. So, the company had to make a settlement where they paid $200,000 to Illinois. There is also an accidental byproduct of fraud prevention, and it was reported by ProPublica.

Frequently Asked Questions (FAQs):-

Here are some interesting questions and answers that most people ask about Chime.

Ans: When it comes to the cons of Chime, there are a couple of cons that you must look into.

• Recently, there have been so many customer complaints regarding Chime funds and accounts in accessing.

• If you want the mobile check deposit, then you need to sign up for direct deposit.

• If you want in-person service, then there are no physical branches to do that.

Ans: The Chime has its own debit card, and it works the same as other debit cards. You can simply put money into your checking account, Chime, or you can add money as well. Suppose you already have a checking account, then there are already available funds that you can spend when you have the Chime Debit Card. There are also other features that a user can get.

Ans: There are so many different security measures that users want when they use any financial platform. So, coming to Chime’s safety is incredibly safe. Right now, there are more than thirteen million users. When it comes to online banking, then Chime is one of the most helpful and highly secure accounts. So, Chime is a great solution for many banking needs.

Final Words

Chime had to face other controversies as well. Chime practices closing accounts, and it doesn’t give any prior notice before that. Also, it doesn’t tell the reasons to the consumers. There was a report by the Consumer Financial Protection Bureau. And the organization received more than 3,500 complaints against Chime.

After closing the accounts, consumers face difficulties in retrieving their accounts. And in that time, there can be so many problems. Also, the resources are limited as there are no banks associated with it.

I hope you will find this article interesting, and please share and give your feedback.

Thank You.

Read More: