Everything You Need To Know About Brex

Whether you are a small business owner or a big business tycoon, you can make use of the Brex credit cards. The Brex 30 is a charge card best for business owners who have a regular cash flow in their accounts and can pay off all of their credit card balances every month.

The best part about this credit card is that business owners don’t have to pay any hidden fees, and they can potentially maximize their rewards without extra payment for the privileges they want. There are even higher potential rewards for those who can qualify for the Brex Exclusive ( a reward status).

Now, the question is, how good is this credit card for all of your corporate spending and earning rewards? If that is your question, you can go through this article and learn more about this corporate credit car

Brex Credit Card Overview

Brex, a corporate credit card, allows businesses and business owners to boost their spending and grow fast. Entrepreneurs and businessmen looking for ways to increase their business and boost cash flow can use the Brex credit card.

The card requires no personal guarantees, there are no hidden fees or annual fees associated. Also, users can gain higher limits (10x to 20x higher compared to traditional credit card owners.). More so, corporate users can earn rewards on almost every single one of their spending.

Most importantly, if you were looking for a business credit card that could be used with a trial, then Brex is a good option. The reason is that they offer you discounts and services for the first year of your use. So, you can give it a trial and see if it fits your goals.

Read More: Zik Analytics Review, Pricing, Overview, Ratings And Features

Features of Brex Credit Card

Here are the feature of the Brex credit card –

Reward Rates

Brex Credit card users can earn up to 8x points for their daily purchases. But the points earned or the monthly purchases are up to 7x.

Welcome Offers

Brex credit cards allow users to earn up to 50,000 points as a welcome bonus. The first 10000 points can be earned for the first $1000 spent using the Brex credit card. The next 10000 points can be earned by spending $3000 within the first three months of opening an account with Brex

Also, users can earn up to 20000 points when they link their payroll to a Brex account. You will earn 8x on rideshare purchases and 5x through booking travels using Brex Travel. 4x reward points can be earned through Brex restaurant payments.

Zero Annual Fees

There are no hidden fees associated with Brex credit cards. Corporate business wonders will also love the fact that Brex does not charge any money as annual fees. If you want to make the highest reward points, you need to make payments on a daily basis

Brex Credit Card Pros & Cons

There are both pros and cons of using the Brex Credit card. Go through the following pros and cons to have more clarity about this credit card.

- Users don’t need to have a personal guarantee to use the Brex credit card.

- This credit card helps users build business credits when their payments get reported to the business credit bureaus.

- Certain purchases can help the cardholders earn up to 7x to 8x points in reward.

- Users can redeem their reward points for fights, gift cards, hotels, and statement credits.

- Brex credit card provides high credit limit potential. This is determined by the company’s equity dynamically and spending patterns.

- Companies such as Slack, Apple, QuickBooks, and Google Ads, offer users with discounts.

- There is no hidden or annual fee added to this credit card.

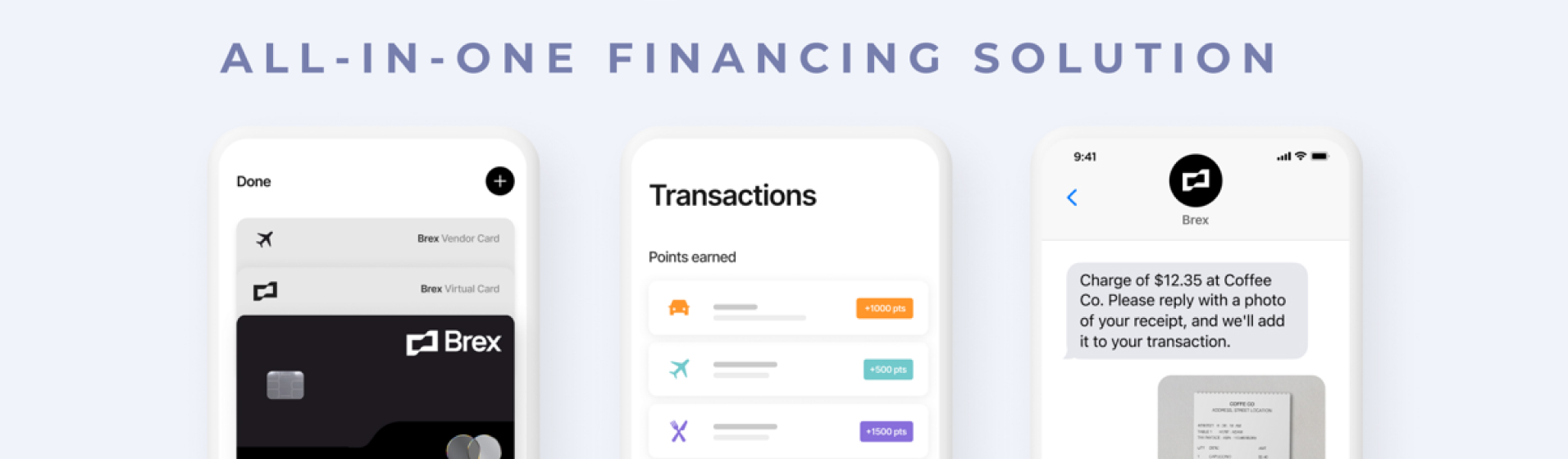

- Employees can avail of virtual cards instantly.

Brex Credit Card Cons

- Users need to make daily payments in order to receive the highest rewards rate.

- There is no option to carry any balance. This gives almost no room for flexible options for payment.

- The reward system is a little complicated. Sometimes you get rewards on categories that hardly require you to make any payment.

- Users need to have a business checking account that has a minimum of $50,000 in deposit.

Brex Credit Card Review

Brex Credit cards come in two different varieties. You can opt for one that pays off daily and the other one monthly. So, if you are applying for a Brex credit card, you will be able to choose between two of these options.

While other credit cards look for the owner’s personal credit scores, the Brex credit card evaluates the company’s cash balance and patterns of expenditure to determine their creditworthiness.

This method is beneficial for entrepreneurs and businessmen who are just starting out. Even if they have no credit history, they can earn different benefits from having a corporate credit card through BRex. Also, new business owners might find this credit card unique and helpful since they don’t have to guarantee their debt personally.

However, there may be certain merits of using this card, Brex still does not fit the requirements of all types of business owners. The first limitation is that the company should be registered in the U.S. They should also be willing to provide Brex with their bank information. Users also need to be properly funded to qualify for their monthly repayments.

So, if you are planning to get this corporate credit card, you should also consider these limitations.

Read More: Everything You Need To Know About OpenSea

Bottom Line

Brex is perfect for small business owners based in the U.S. who are just starting out and have a healthy cash flow through their business. Indeed, there are high chance of earning higher reward points, but there are certain limitations that might make you reconsider. Judging by the discounts and welcome points, Brex is definitely worth a try if you are a new entrepreneur and looking for a personal guarantee-free corporate credit card.

I hope that this review was helpful. However, if you have any additional questions, you can ask me through the comment section below.

Read Also: