Valuing A Business: What Is Business Valuation & Why Is It Important?

When selling a business or buying one, both parties want to sell or buy the “Most Valued Business.” as a result, evaluation is necessary. So, how does valuing a business work? If you are looking for an answer, then I will suggest you go through this article.

There might be different reasons behind this evaluation – selling the business to start another or retiring from it is one of many reasons to sell a business. But, when selling a business or buying one, it is necessary to know the market value so both parties can profit from the handover.

What Do We Call Valuing A Business?

When selling a business out, there is a process called business valuation to determine its market value. During the evaluation process, a professional business evaluator goes through all the aspects of the business to help decide on its monetary value.

Not just selling a business, determining the value of a business is also important for a business that wants to improve itself. Business evaluation allows the management or authority to see different areas that need development. It also offers a financial graph of a company’s performance.

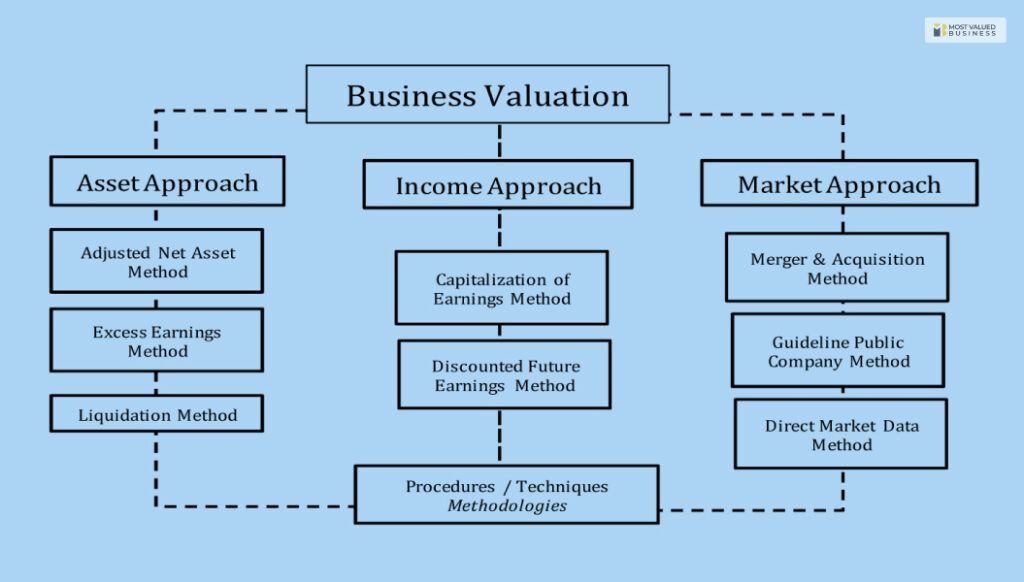

The process of valuing a business offers owners valuable insights for profitable decision-making. There are different approaches to valuing a business. For example – income-based, book value methods, and asset-based approaches are some common methods for business valuation.

Read More: 11 Tips For Successful Global Expansion Of Your Business

Key Aspects Of Valuing A Business

Businesses go through many ups and downs sometimes. Sometimes they want to sell the entire or some portions of the business, merge with another, or acquire a new one. That is when the process of business evaluation is required. When valuing a business, the result should include some key aspects such as –

- Valuing a business is the method of evaluating the economic worth of a business in its respective market.

- Valuing a business may include an analysis of the management of a company. It also includes the capital structure and the prospect for earning or the valuation of its assets in the current market.

- The tools used for the valuation of a business vary from one business to another.

- The most common way to evaluate a business includes the review of a business’s financial statement, discounting cash flow, and other necessary models of the business.

- There are some simple and common methods used for the evaluation of a business. Some of them are – earnings multipliers, market cap, or book value, and others.

However, before evaluating a business, it is important to know that the process for business evaluation has a significant effect on the team. There are different formal models, and choosing the right one for your business evaluation is also crucial.

Different Ways Of Valuing A Business

Here are some of the most common ways of evaluating the market value of a business –

Tally The Value Of Assets

If you want to evaluate your business, then the easiest place to start is the balance sheet. You can just add all the assets the business owns, different equipment, and inventory as well. Then subtract the debts or liabilities from the value of the business. However, it is not always easy to get the proper valuation of your business by calculating its net value. It is usually worth more than the net assets.

Based On Revenue

You can also base the value of your business on the amount your business generates in sales. Once you have determined the amount of sales, you have to compare the sales value with your competitors in the respective industry. It would help to consult with a stockbroker or a business broker. They will compare the sales your business generated with that of other businesses in the same industry.

Using Earnings Multiples

It is possible to get a more relevant result of the company’s valuation through the multiplication of its revenue. The price of earning ratio is beneficial in valuing a business. You have to estimate the earning of your company for the upcoming few years. If you find a P/E ratio of 15 and a projected earning above $200000 per year, then the business would be evaluated at $3 million in worth.

Through Discounted Cash Flow Analysis

Another way of valuing a business is through the discounted cash flow analysis – a fairly complex formula. It looks at the annual cash flow formula of the business and projects in the future. Then it uses the “net present value” formula to discount the value of the future cash flow to today’s time. You will easily find and be able to use an online NPV calculator. Or you can use an NPV calculator in Excel.

Beyond Financial Formulas

It will not be accurate to base the business value on the number crunching. You can also consider the value of your business based on the geographical location. Additionally, you can also consider the potential strategic value for a would-be acquirer, given there are business synergies.

Importance Of Valuing A Business

The importance of evaluating one’s business is essential. It offers entrepreneurs and founders different insights. These terms help a business with market competition; it also helps them with an idea of the asset value.

- Through business evaluation, entrepreneurs learn how much they can reinvest in the business.

- They also learn what portion of the business needs to be sold or selling what portion will help the business make more profit.

- Also, potential buyers and investors also find great intel about the business’s potential to generate revenue. This helps them make a careful and thorough decision about investing in the business.

- Business evaluation is also a vital tool for measuring the prospect of the business.

Read More: How To Start A Business? – The Most Valued Question Budding Entrepreneurs Ask

Bottom Line

The importance of valuing a business is huge. Whether it is about selling a business or investing in one, evaluation of its assets is necessary. I have explained the general idea about what evaluating a business is and different ways of evaluation. I hope that this article was helpful.

However, if you need any further help, please let us know through the comment section. We will get back to you as soon as possible.

Read Also: