Using A Business Valuation Calculator: All That You Need To Know

Owning a business is one of the most unpredictable things to do. You never quite know what happens next. unless you know how to keep track of the workings of your company. We are here to discuss the answer to your question, “what is a business valuation calculator?” Let’s go!

Welcome; we are here to help you with just that. Having proper knowledge about assets, liabilities, market trends, etc., would help you make some predictions. These predictions can mean life or death for a company. It can either sink a company or keep it afloat.

So, whether you are a budding entrepreneur who is looking to invest in a company or just someone who likes to know about the workings of a market, this guide is for all.

How Do You Calculate the Value of A Business?

A buyer’s offer solely depends on a single factor, the valuation of your company. This would determine the overall size of the offer and other ancillary factors related to a business transfer. Moreover, the overall valuation of your company is also important when it comes to insurance and determining the nature of the returns. Hence, a business valuation calculator can be termed as an asset that is designed to work as a blueprint for any and every administrative decision.

Before moving ahead, we need to familiarize ourselves with two key terms, return on investment or ROI and relative risks or RR. While ROI helps us understand the amount of money that has been put into a business, RR would help us understand the risks involved in the overall business venture. Thus, as is apparent from the terms, a more favorable ROI and a lower RR would result in the offer price being higher and vice versa.

In simpler terms, ROI is essentially the measure of value or money you have earned after paying all the expenses like rent, salary, taxes, etc. This helps in understanding whether an entrepreneur a business is safe for investment. The basic formula for ROI calculation is as follows:

(Return/Original Investment) x 100%

For example, your investment in a business is around $100,000, and your net profit after paying each and every expense is around $20,000. Therefore, to calculate the business value, we must put our values according to the equation presented above. As a result, your ROI should be 20%.

(20,000/10,000) x 100%= 20%.

Read More: How To Start A Business? – The Most Valued Question Budding Entrepreneurs Ask

Things To Factor in:

A business is a complex machinery that is working. It has several cogs and pieces of machinery that work together to produce results. Hence, just knowing the ROI is not always enough. A ‘favorable’ ROI should also balance out the potential risks. Then only you understood (nominalization) the complete scenario better. In other words, a business value calculator is only effective when the equation factors in the risks that come with it.

Hence, as an entrepreneur, you need to make an actual effort to maintain a certain amount of balance. Like for example, A ten-year-old venture with increasing profit margins over the past ten years may involve less risk than a two-year-old venture with flat revenues.

Therefore, here are some factors that you need to keep in mind while making your decisions regarding new business ventures:

- Predictable key drivers of newer sales figures: Factors that pull in customers and increase the overall sales of your business.

- Growth or expansion potential: To see how and where you can grow your business.

- Established relationship with suppliers: A good rapport with suppliers is equivalent to fewer logistical errors and smoother production.

- A loyal workforce: Any business needs a loyal workforce to keep the production rolling. A resentful workforce would often resort to strikes, etc., and this could be an alarming situation from a business perspective.

- A high percentage of repeat sales or returning customers: A business always thrives on returning customers. It not only makes the sales go up but also forges a strong reputation for a business.

- No past or present lawsuits: pretty much self-explanatory. As an investor, you should avoid investing in a business that is involved in a lawsuit. Dealing with this would only increase your overall investing amount with zero to no returns.

- Establishing a clean trademark: A fresh coat of paint or branding can provide a new image to the company. In the long run, this helps to build newer relationships with investors and customers.

- Documented systems and processes: For a business to run smoothly, it is imperative that every department knows its job and authority. Therefore, it is imperative that proper documentation exists.

So, a proper knowledge of how to use a business valuation calculator, along with the factors above, can really help you to make a more informed decision.

Types Of Business Valuation Calculators:

There are several ways to determine the overall value of your business. Here are four of the most popular methods of business value calculator that almost all Business Valuation Services use to estimate the overall valuation of their company:

Book Value (Asset-Based Method):

This method factors in your assets and liabilities simultaneously The overall formula for calculating using this method is relatively simple. You just have to minus the liabilities like debts, loans, commercial mortgages, etc., from the overall assets, which could include cash, inventory, shares, etc. Like for example, take your overall assets to be $1000 and your liabilities around $300. Therefore, the overall valuation of your company is around $700.

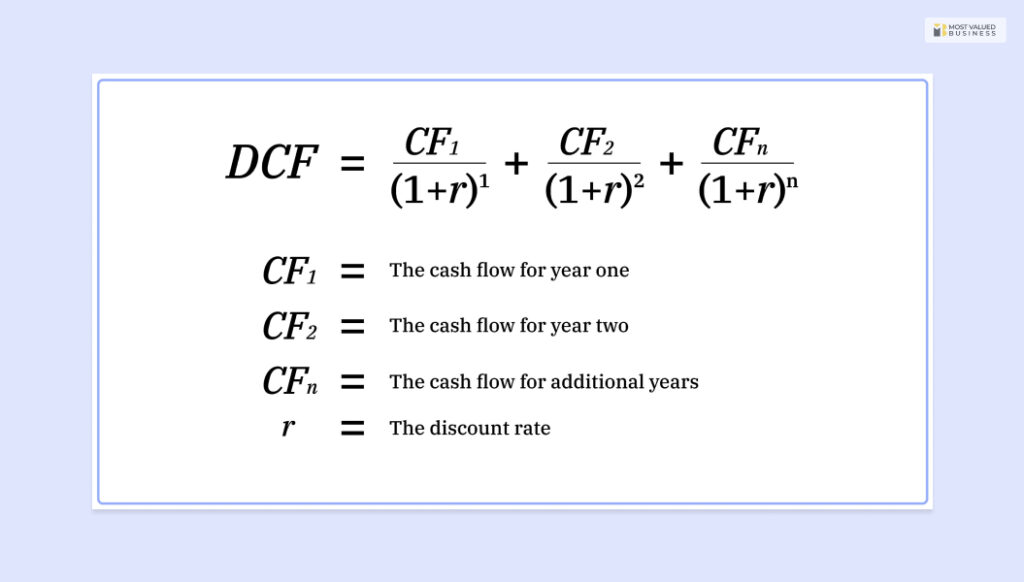

Discounted Cash-flow:

Unlike the previous method, this method focuses more on the prospect of a business. According to experts, “This method estimates the cash flow your business is projected to produce into perpetuity and then discounts this back into current dollars (called net present value or NPV), while also accounting for the level of financial risk indicated by your business or industry.” Therefore, this business valuation calculator is more suited to precise future predictions.

Revenue/Earnings:

This takes your business’ revenue or the gross income and multiplies it using an industry multiplier to come up with a value for evaluating your business. Remember that a small or medium-sized business would usually fall from 1 to 3. Meanwhile, a larger business set-up would have 4 as the industry multiplier. Therefore, if your overall revenue is around $1,000 and your industry multiplier is 3. Then, your business value is around $3000.

Market Comparison:

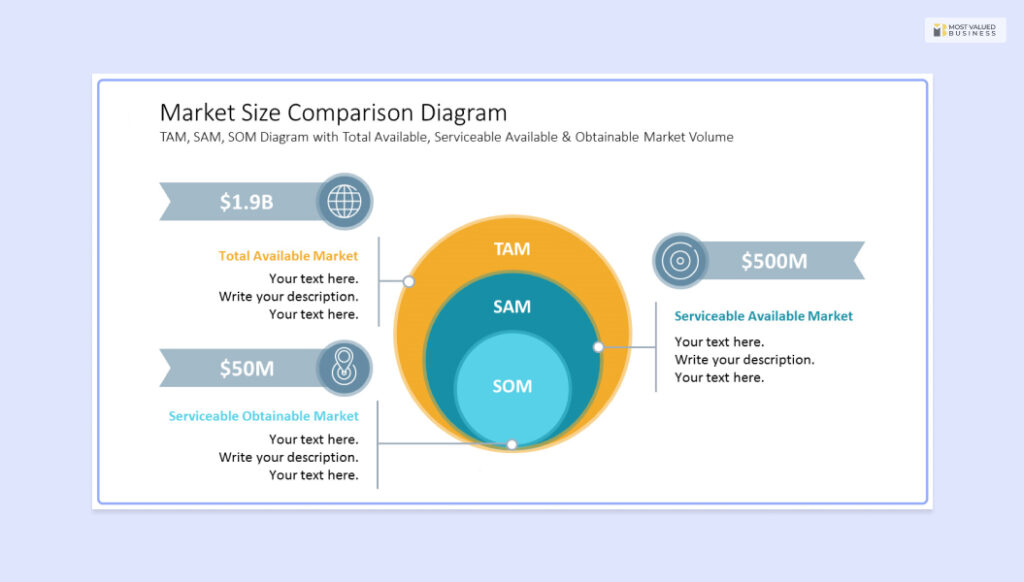

Primarily a small business valuation calculator, it tends to compare businesses in the same market with similar customer bases. For example, you are a florist who sells bouquets at a fixed price of $5. However, another person sells the same product to a similar customer base at around $3. Still, the latter is making more monthly profit. Therefore, by doing a basic market survey, you can estimate a price that appeals to a customer base and then decide on it.

Read More: Want To Start A Business? Here Are The Top 10 Cheap Businesses To Start

Final Thought:

Knowing how your business is doing in a current market environment is significant. It is the first step in being a successful entrepreneur. And a business valuation calculator helps you with that. It provides a proper estimate of the running of a business which can prove the life or death of a company. Here we have listed some of the calculators that you can employ to estimate the valuation of your company properly and subsequently move ahead. Ciao!

Read More: