Enterprise Value Formula: What Is It? Importance And Calculation

Often considered a more comprehensive substitute to market capitalization, the Enterprise Value formula helps measure the total value of a company.

The enterprise value formula includes in the enterprise value calculation of the company’s market capitalization along with the long-term and short-term debts and any cash or cash equivalents that are available on the company’s balance sheet.

Points To Remember

- The Enterprise Value formula helps measure the total value of a company and is often considered a more comprehensive substitute to equity market capitalization.

- To calculate enterprise value, you will have to calculate the market capitalization of the said company, along with its long-term and short-term debts and cash and cash alternatives shown in the balance sheet of the company.

- Enterprise value plays an important role as it helps in measuring all the financial ratios that help determine the company’s financial performance.

Read More: How To Start A Business? – The Most Valued Question Budding Entrepreneurs Ask

Components Of The Enterprise Value Formula

These are the following components that must be included in the formula in order to calculate the enterprise value of a company:

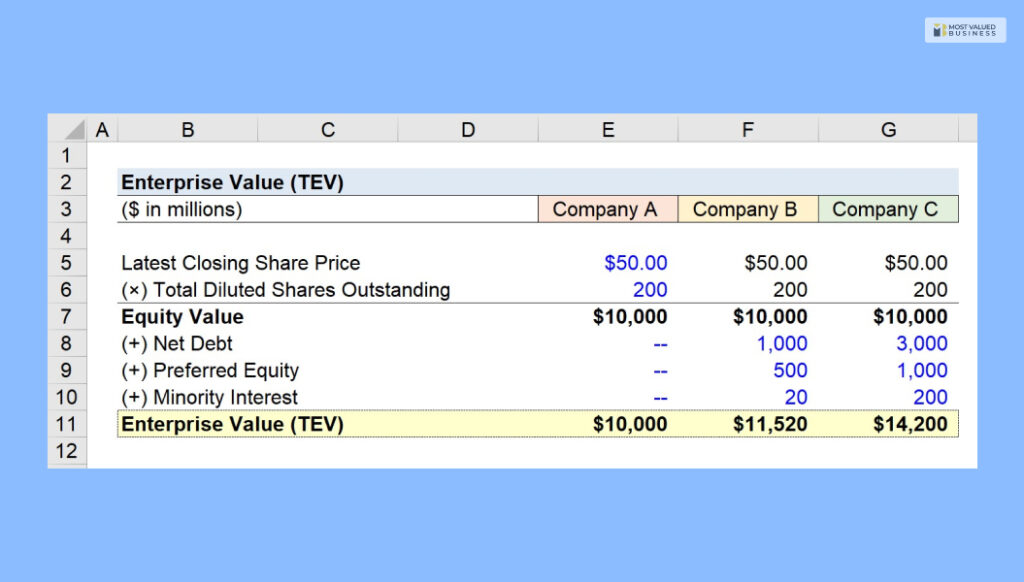

Market Cap: This is the total value comprising the company’s outstanding common and preferred shares.

Debt: The total sum of the long-term and short-term debts.

Unfunded Pension Liabilities[if applicable: This is the amount that is lacking in order to cover the pension payouts or the amount that the company requires to keep separately to make pension payments in an unfunded plan.

Minority Interest: This counts for the equity value of a subsidiary that has less than 50% ownership. This can be added to Market Cap while calculating EV.

Cash And Cash Equivalents: This accounts for the total amount of cash, drafts, money orders, certificates of deposits, marketable securities, commercial papers, money market funds, short-term government bonds, or any Treasury bill under the company’s possession.

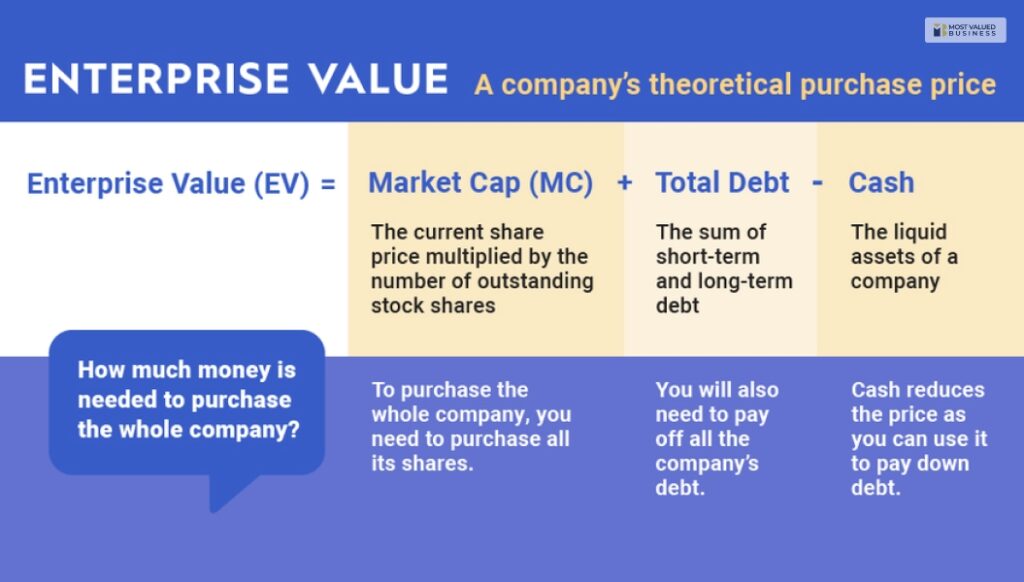

How To Calculate Enterprise Value Formula?

Here is the Enterprise Value Formula, which helps you to calculate the enterprise value of your company:

| EV = MC + TOTAL DEBT – C |

in which,

MC: market capitalization. It is calculated by multiplying the number of outstanding stock shares by the recent price of each share.

Total Debt: calculated by adding the long-term debts with the short-term debts.

C: this is the cash and cash equivalents. This is the liquid asset of the company; marketable securities may not be included.

While calculating market capitalization, if it is not already available online, you are required to multiply the outstanding shares by the current value per share.

Next, you would have to add all the debts that are available on the balance sheet of the company.

Finally, generate the sum of market capitalization and total debts, and then subtract the cash and cash equivalents from the total sum, and you will have the Enterprise value with you.

Why Do You Need To Use The Enterprise Value Formula?

There are significant differences between an Enterprise Value formula and a simple market capitalization. It is also considered a more accurate representation of the value of an organization.

EV conveys to the investors the value of a company and how much would a third party need in order to purchase that company.

However, there is yet another consideration; where the company’s EV can come out negative if the cash and cash equivalents exceed the total sum of the market capitalization and total debts.

This signals that the company is not putting its assets to work efficiently and it has too much-unused cash in the business.

This extra cash can be used for many benefits like maintenance, development, distribution, expansion, buybacks, research, bonuses, employee pay raise, or paying back debts.

Limitations Of An Enterprise Value Formula

As I have mentioned earlier, total debt is included in the EV formula; however, it is important to consider how the management of the company is utilizing these so-called debts.

For instance, capital-intensive industries like oil and gas will typically carry out noteworthy amounts of debt for fostering growth. This results in the skewing of EVs during company comparison across industries.

It is also important to consider if the company in question is going through an acquisition or a merger. In that case, the merging company will have to account for all the debts that it is taking in the merger.

Investors further use this information evaluate how the merged companies will look shortly.

For most financial metrics, it is always preferable to compare companies that belong in the same industrial field. This gives a better understanding of how to value a company in comparison to its competitors.

Frequently Asked Questions!! (FAQs):

Ans: Enterprise value, or enterprise value formula, is an indicator that helps in determining the total value of a company. This is a more comprehensive substitute for market capitalization.

Ans: You may calculate the enterprise value by adding up Market Capitalization and Total Debts and then subtracting Cash and Cash Equivalents from the total sum.

Ans: Enterprise value is the total value of a company. The market value is the value of its shares in the stock market.

Ans: Yes, the enterprise value may result negative. However, that’s the case only when the cash and cash equivalents value exceed the total sum of market capitalization and total assets. If the value is negative, you must consider that there is a lot of unused cash in the company.

Read More: How To Start A Business With No Money? : Start A Business When You Are Broke

The Bottom Line

The enterprise value formula gives an estimate of the total value of the company. Other companies that are considering an acquisition or a merger generally use this formula.

Investors may look into the EV to make estimations of its size and worth. This helps them decide if they want to invest in their stocks.

This is all that you should know about the enterprise value formula. If you’ve any further questions, feel free to drop in a comment below, and I will be happy to answer.

Read Also: