How To Get A Startup Business Loan With No Money?

First, let me get this right. Just because you can get a loan without money does not mean it is the best option. How to get a startup business loan with no money? I will tell you how. But, it is a little risky to get a startup loan without any cash flow, revenue, profits, or assets.

It is advisable to wait until your business is more stable and generates some revenue. There might also be different and more affordable interest rates and repayment options in other funding options you find in the future.

In this article, I have discussed how you can avail of business startup loans with no money. First, I will discuss different funding options startups can use for starting small businesses with no money. Then we will get into the process of availing those options.

Funding Options For Startups With Zero Revenue

How To Start A Business With No Money? Is a Big Question but Startup businesses and businesses that don’t generate much revenue do not qualify for loans from brick-and-mortar banks or SBA loans. But there are workarounds and other options you can try.

All lenders do not require your business to generate a hefty amount of revenue for lending. But they might want clarification on how you intend to repay your loan. Here are some of the options you need to learn about –

Equipment Financing

You can opt for equipment financing when you are just starting a business and need specific equipment. This type of loan does not require your business to generate revenue yet.

The equipment loans are granted before the business even starts making any revenues. You get loans based on the cost of the equipment, not the revenues the borrower can generate. The equipment here itself stays as the collateral while starting a business. This makes the lenders invest in the business without any second thought.

Read More: 5 Ways Higher-End Businesses Can Promote Their Brands

Microloans

How to get a startup business loan with no money? You can opt for Microloans in that case. Small businesses can borrow a small amount of $50,000 as a startup cost to help them gear up the business. These businesses do not have any revenue requirement for applying for loans and starting the business.

Businesses can apply for micro-loans to the SBA and other government and non-profit or P2P agencies.

Small Business Credit Cards

You can also get small business credit cards. Business credit cards work like credit cards. This allows the borrowers to borrow up to a previously determined credit limit. Some business credit cards add different perks, like cashback on the purchase of office supplies. But, if you want to escape interest charges, I recommend paying off your balance each month in full.

In this case, you need to develop a good credit score and future revenue prospects.

How To Get A Startup Business Loan With No Money?

So, how do you get startup funding when your business is ten miles away from generating revenue? Here are some pointers you need to keep in mind when progressing.

Understand The Requirements Of Your Lenders

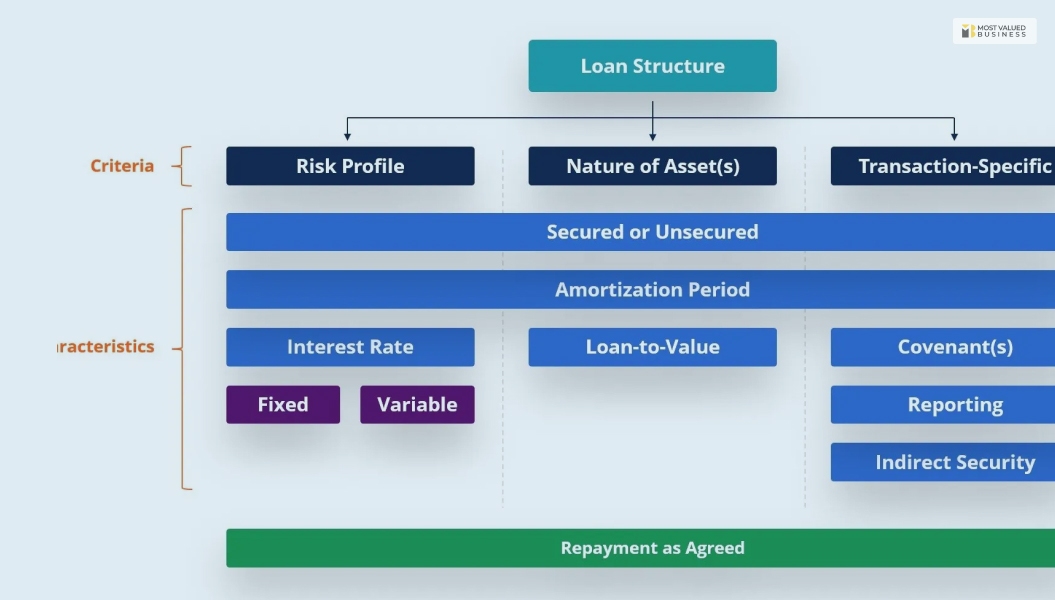

When you have no money in revenue and want to raise funds for the business, you will consider the help of different lenders. But lenders also have their own sets of criteria. They go over the credit history of their borrowers, their collateral availability, and the borrower’s capacity for repayment from their future revenue. Borrowers savings and their time in the business also work as important criteria.

Before applying for or accepting loans from your lenders, understand their criteria and assess your capabilities against them.

Know Your Assets & Cashflow

One of the most important parameters for your loan disbursement, the lender might want to know the source of your earning. Lenders are usually interested to know where their repayment will come from. That is why it is important to understand your assets clearly and the cash flow you can generate against a specific timeframe.

You Might Have To Sign A Personal Guarantee

The loan seeker might have to sign a personal guarantee when taking loans from lenders. Yes, there are certain risks in signing such guarantee papers. You might lose your home, car, or savings if the business defaults on the loan.

As I have said before, signing the personal loan guarantee will not be difficult if you are aware of your assets and your cash flow. However, a little miscalculation on your possibility of repayment might cost you dearly.

Be Prepared On How Much You Can Pay

You should be able to pay the loan transferred to your business account with the interest added. The repayment depends upon the interest rate, repayment frequency, and total time for loan repayment.

If the expected payment for the loan is more than you can afford, it will be wise to go for a more affordable option.

Is It Wise To Take Business Loans With No Money?

If your business is already generating some revenue, you will have better options than loans with no money. But, for startup businesses with zero revenue, equipment loans are alright and common. There are a few reasons prompting you to opt for a startup business loan –

- Businesses usually need to borrow money for inventory, rent, equipment, or payrolls. These loans give them the necessary initial push and help them start. If you can gather money for loan repayment, you can consider startup business loans with no money.

- Growing the business after the startup phase is a success also makes small startups seek funding. They can opt for loans with no money in this case as well. When startups don’t have enough savings for bootstrapping, they can opt for loans with no money.

- Some businesses involve customers asking for invoices. But they do not pay for weeks. Businesses with cash locked up in unpaid invoices can also seek business loans without money.

Bottom Line

How to get a startup business loan with no money? Once you have gone through this article, you will understand the process. This article also elaborates on different funding options for businesses that generate no revenues.

I hope that your queries are resolved through this article. For further solutions like this, please comment below and let us know.

Read Also: