Optimizing Mileage Tracking Software for the 2026 IRS Rate Changes

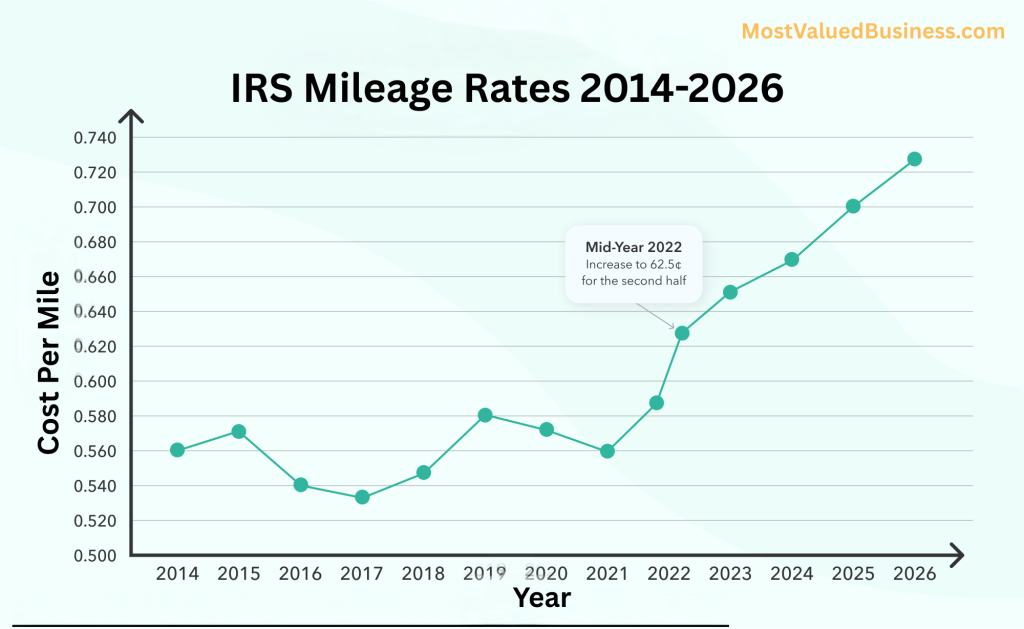

The IRS mileage rate update for 2026 is more than a small adjustment. It changes how businesses calculate expenses, reimburse employees, and prepare for tax season. With the new rate set at 72.5 cents per mile, up from 70 cents, companies that depend on mileage tracking now have a clear choice. Either adapt early—or risk missing deductions and creating compliance issues.

If your business relies on driving for work, sales, delivery, real estate, or field services, this change matters to you. The right mileage tracking software can turn a regulatory update into a financial advantage. The wrong setup can quietly cost you money.

Let’s break down what this shift means and how you can optimize your tracking systems before the new rate fully takes effect.

Why Accurate Mileage Tracking Matters More Than Ever

Mileage tracking has always played a role in tax deductions. But with the 2026 IRS mileage rate increase, accuracy becomes even more critical.

At 72.5 cents per mile, every recorded trip carries more financial weight. That means better deductions, if your mileage logs hold up under review. Sloppy records don’t just reduce deductions. They raise red flags during audits.

Industries that log heavy travel already feel this pressure. When driving is part of daily operations, small errors add up fast. Missing miles. Rounded estimates. Forgotten trips. Over a year, those gaps can cost thousands.

This is where modern mileage tracking software earns its keep.

Automated tools eliminate manual guesswork. They capture trips as they happen, store them digitally, and create defensible records that align with IRS standards. Compared to paper logs or spreadsheets, the difference is night and day. Fewer mistakes. Less stress. More confidence when tax time rolls around.

Core Features Your Mileage Tracking Software Must Have

Well, there are many mileage tracking tools available for your ease. To fully benefit from the 2026 rate increase, your software needs specific capabilities that go beyond basic logging.

1. GPS-Based Trip Tracking

GPS integration is non-negotiable. It records trips in real time and documents start points, end points, and exact distances. No estimates. No memory lapses.

This creates a verifiable trail, something the IRS actually trusts. When mileage claims match real-world data, audits become far less intimidating.

2. Automated Trip Classification

Mixing personal and business trips is common. Separating them manually? That’s where mistakes happen.

Automated classification solves this problem. The software helps tag trips correctly so only eligible business mileage counts toward deductions. This matters even more when employees use the same vehicle for work and personal use.

3. Accounting Software Integration

Mileage data shouldn’t live in isolation. Integration with platforms like QuickBooks or FreshBooks allows mileage expenses to flow directly into financial records.

That means cleaner books, faster reimbursements, and easier reporting. It also helps leadership see travel costs clearly, without digging through spreadsheets.

Using Data Analytics to Strengthen Compliance

Mileage tracking is about understanding patterns apart from recording trips. Advanced analytics features allow you to review historical travel data and spot trends. Maybe certain routes get repeated unnecessarily. Maybe travel spikes during specific times of the month. These insights help you optimize operations and reduce avoidable costs.

Analytics also improve audit readiness. When your data looks consistent and logical over time, it supports your compliance position. For larger teams, even small improvements in route planning can translate into noticeable savings over the year.

Staying Ahead with Timely Software Updates

IRS mileage rates don’t change once and disappear. Guidelines evolve. Documentation rules shift. Sometimes eligibility criteria change, too. That’s why keeping your mileage tracking software updated is critical.

The best tools roll out automatic updates that reflect new IRS rules without requiring manual intervention. This ensures you stay compliant even when regulations adjust mid-cycle. Reliable customer support also matters. When updates roll out, questions follow. Feature updates that enable you to have quick access help you save every millisecond that counts. It is an ideal to check your system time to time, especially during transitions like the 2026 rate change. If you keep your eyes open, no long-term issue can do harm.

Audit Preparation Starts with Documentation

When audits happen, documentation decides the outcome. Your mileage tracking software should generate detailed, IRS-ready reports. That includes dates, distances, trip purposes, and locations. Everything should be easy to retrieve, even months or years later.

Quick access to clean records reduces stress and protects your deductions. It also shows that your business takes compliance seriously, which matters more than many people realize.

Turning Rate Changes into a Business Advantage

The IRS mileage increase highlights something important. Travel expenses are a major cost centre and a major opportunity. When you pair the 72.5 cents per mile rate with strong tracking tools, you improve more than tax deductions. You gain visibility, efficiency, and better financial control.

Training employees on proper software use also plays a role. When people learn how to log trips correctly, you will see quite a significant improvement in data quality. Feedback loops help refine the process even further. In the end, businesses that adapt early don’t just stay compliant. They operate smarter.

As 2026 approaches, the companies that optimize mileage tracking now will be better prepared to manage costs, reduce risk, and capture every deduction they’re entitled to without scrambling later.

Choosing the Right Mileage Tracking Tools for IRS Compliance and Efficiency

Now that you understand why accurate mileage tracking matters with the 72.5 cents per mile IRS rate for 2026, it helps to know what tools are actually out there and why some are better than others.

Not all mileage tracking software works the same. Some are simple apps that log distance. Others include deep features like reporting, IRS-ready logs, cloud backups, and expense integration. Actually, it depends on your travel and your bookkeeping. Below is a quick comparison of popular mileage tracking apps and what they’re best at, based on features that matter most for tax compliance and business use:

Mileage Tracking Tools Comparison

| Tool | Key Features | Best For | IRS-Ready Reporting |

| Everlance | Automatic GPS tracking, expense tracking, IRS-ready reports | Small business owners, freelancers | Yes |

| MileIQ | Passive trip logging, simple classification | Individuals, light travel | Yes |

| Shoeboxed | Mileage + receipts, export to accounting | Businesses needing full expense management | Yes |

| Fuelshine | Automatic trip capture, IRS-ready reports | Frequent drivers & gig workers | Yes |

| MileageWise | AI logs, past trip reconstruction | Users needing audit-proof historical data | Yes |

Here’s why these tools elevate your mileage tracking and IRS compliance game:

- Automatic GPS tracking moves you away from manual logs, which are error-prone and often fail audits.

- IRS-ready exportable reports give you structured data formatted for tax returns or reimbursement documentation.

- These systems cover you with Multi-vehicle and multi-user support. This is genuinely helpful if your business runs several cars or teams.

- You no longer have to worry about cloud backups and integrations with such tools. Automatic features in these tools reduce your record-keeping headaches.

Using one of these tools doesn’t just make your records cleaner. These are designed to help you dodge common IRS pitfalls. Like incomplete logs or misclassified trips that cost deductions and much more.

Conclusion

Automated mileage tracking software is now becoming more of a necessity than a convenience. It protects you from errors that cost dollars and supports smoother reimbursements. Moreover, it feeds you all the required information that perfectly curates your travel plan. After all its matter of efficiency and cost saving.

Read Also: