Everything You Need To Know About Plaid (Detailed Overview)

“Plaid gives developers the tools they need to create easy and accessible user experiences. That’s why more than 7,000 apps and services are powered by Plaid’s API – first network. And with just a few lines of code, your users can connect to more than 12,000 financial institutions.” – Andres Ugarte, Founder & CEO.

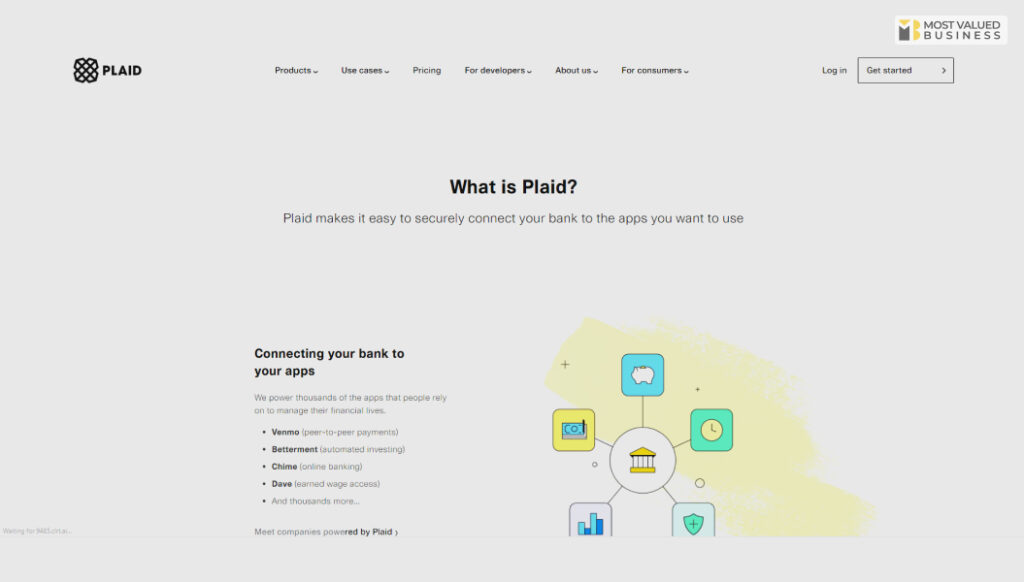

You have definitely experienced and encountered Plaid when you are connecting your bank account through a financial app such as Venmo, American Express, or even Upstart.

Through Plaid, your financial information is getting verified and authenticated, now companies can transfer sensitive documents and information in a safer way. This is because, through Plaid, your data is secured with encryption protocols during transformation.

Plaid actually sits between credit cards and bank accounts and other financial companies. An example of this is a portfolio management site, such as a budgeting app or Personal Capital, like Mint. These sites need your permission to access any of your documents or account information.

Moreover, maybe you are feeling hesitant about it, but don’t worry about your security; between you and them, Plaid comes in. Now that you are aware of what Plaid is, let’s get to know more about this financial software in a detailed way.

Plaid Details

Before we dig deeper into Plaid, here are a few important details about Plaid that you might think of as helpful information.

| Industries | Finance, Financial Services, FinTech |

| Headquarters Regions | San Francisco Bay Area, West Coast, Western US |

| Founded Date | 2013 |

| Founders | Zachery Perret, William Hockey |

| Operating Status | Active |

| Last Funding Type | Series D |

| Legal Name | Plaid Inc. |

| Hub Tech | Unicorn |

| Company Type | For Profit |

How It Is Used?

It is to be noted that Plaid itself doesn’t have an app for itself, and neither do you have to make an account to use it. The services of Plaid are integrated within certain financial apps, such as Venmo, NerdWallet, Chime, and also Petal, and TomoCredit.

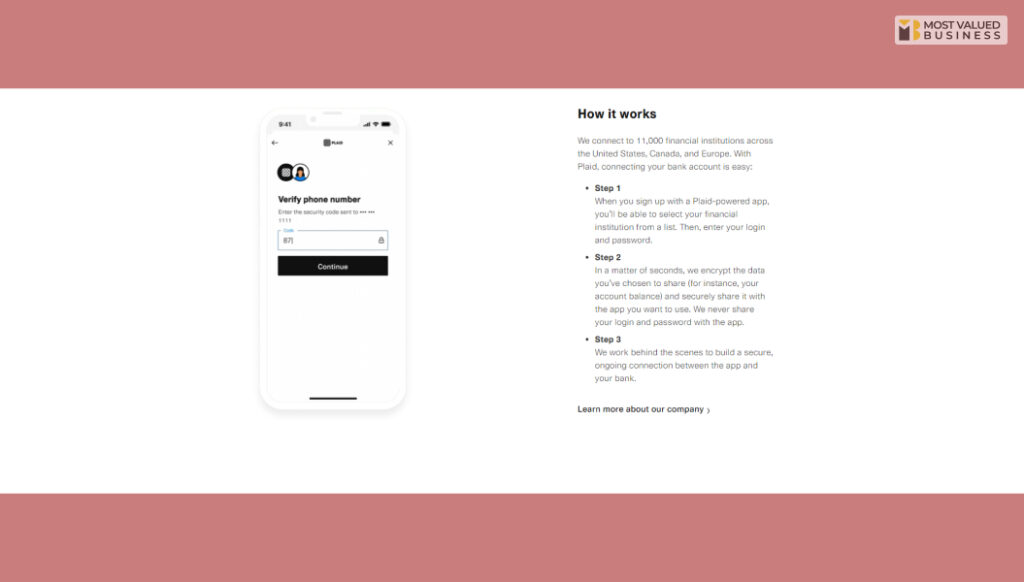

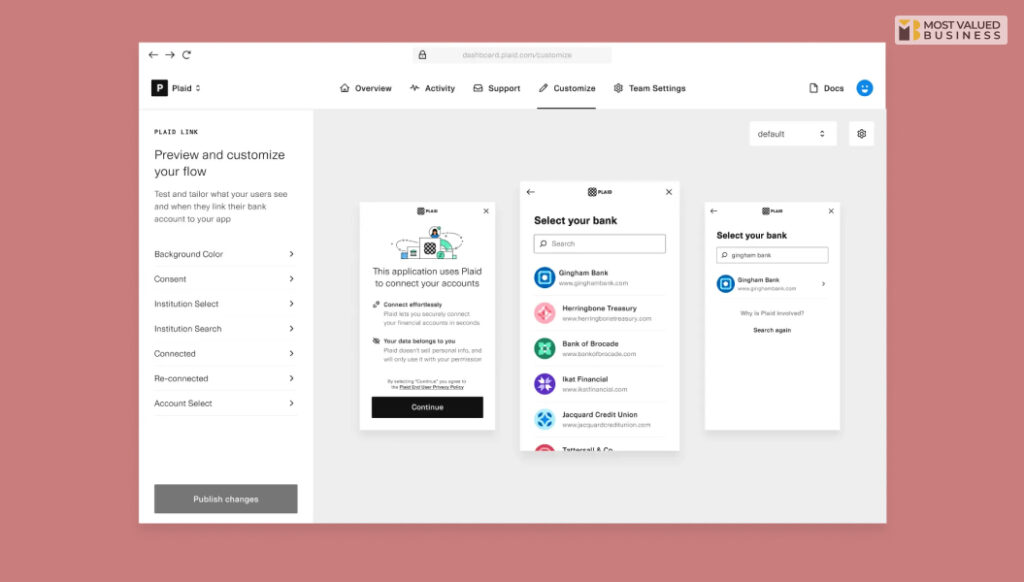

When you are using these apps, the option of adding your bank account details appears, and also the requirement to connect with your bank account. Now, once you put in all the required information, Plaid starts to take it from there. They operate in these steps, such as

- Select or search financial institutions on your behalf.

- Enter the password and username details in order to authenticate your account.

- Authentication of information for security.

- Selection of the finance account with which you wanna connect.

- Connect you with the desired financial service or app.

Tips:- “To keep track of some financial accounts linked to apps through Plaid, you can create a Plaid Portal account on my.plaid.com. The portal allows you to see the type of data you’ve shared with some apps or services. When you no longer want to share data, you can use the portal to disconnect apps or services from financial accounts and delete data stored in Plaid’s system, according to the company’s website.”

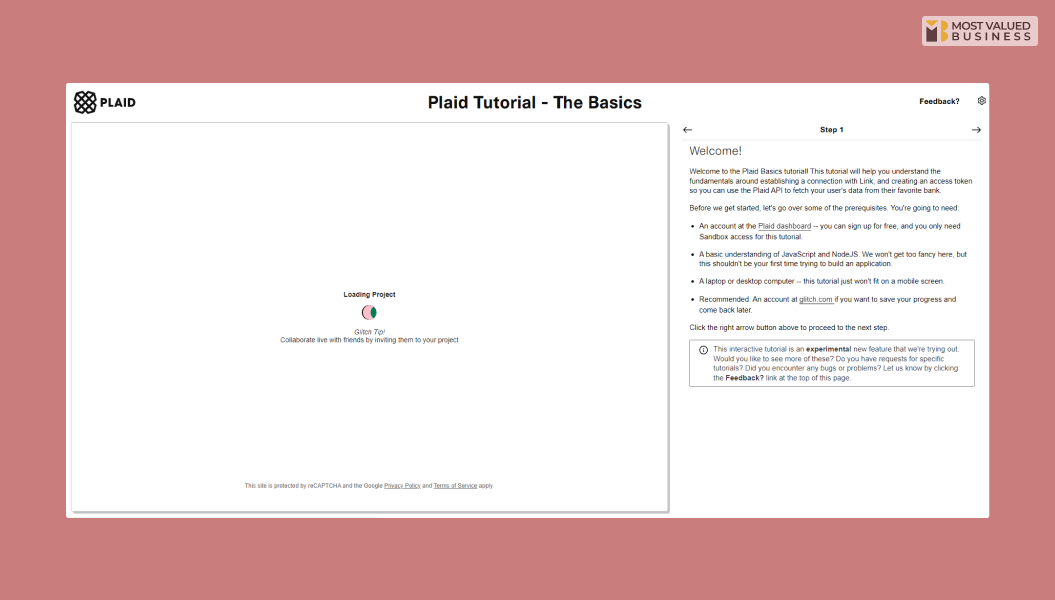

What Are The Basics Of Plaid?

So by now, you got an idea that Pliad works like a middleman between your bank accounts and financial apps.

They offer a secure way of connecting with such apps and any other services that you might be availing. According to Plaid, this third-party intervention is required because.

“There are more than 11,000 financial institutions in the U.S., but they structure and manage their data in many different ways. For an app that wants to enable users to connect their financial accounts, building a digital connection to a single financial institution can take a lot of engineering time and expertise. Now imagine doing that thousands of times. For many companies, it’s not feasible.”

According to your needs and services, Plaid offers the company the following points.

Account Holder Information

“Your name, address, phone number, and email address at a financial institution could be some of the details requested.”

Account Transaction Details

“Your account name or type, account number, routing number, and balances, transaction dates, types of transactions, and transaction description.”

Account-Specific Details

“Your account name or type, account number, routing number, and balance may also be data points that are shared.”

Plaid Settlement:- “Plaid recently settled a class action in which it agreed to pay $58 million to individuals who had used its interface, including Venmo, Robinhood, and Coinbase users. The lawsuit was based on Plaid acquiring more data than it needed and storing the user’s bank account login credentials on Plaid’s systems.”

Wrapping Up!

So now that you are well aware of how Plaid works and how you can use it to you properly secure all your financial information and data.

This way, you can use any financial app without any fear of your data being misused. So now, if you liked this article, you should definitely give this article a like and comment down below.

Read Also: