Company Valuation : Meaning, Approaches, Calculation, And Formula

A company valuation, which you may also call business valuation, is a process that determines the economic value of a business. All the areas of a business goes through analysis while conducting a company valuation which helps to determine the worth of the company and also the worth of all the departments or units individually.

Company valuation can be used to estimate a company’s fair value for several reasons, including sale value, taxation, establishing partner ownership, and even divorce proceedings.

Business owners often approach professional company evaluators to get an objective estimate of the value of the business.

Points To Remember

Company valuation helps to determine the economic value of a company or business unit. Business valuation can be used to generate a company’s fair value for numerous reasons, including taxation, sale value, establishing partner ownership, and even divorce proceedings.

There are varied ways by which the company valuation can be determined, like looking at its market cap, book value, or earnings multipliers, among others.

Read More: Enterprise Value Formula: What Is It? Importance And Calculation

Basics Of Company Valuation

The topic of company valuation is often discussed in corporate finance. Companies conduct a company evaluation when they are looking to sell the entirety or a percentage of their operations or are planning a potential merger or acquisition of another company.

The valuation of a company is the process that determines the present worth of the business, using objective calculations and assessing the business aspects.

A company valuation includes the analysis of the management of the company, its capital structure, future earning prospects, or the market value of the assets.

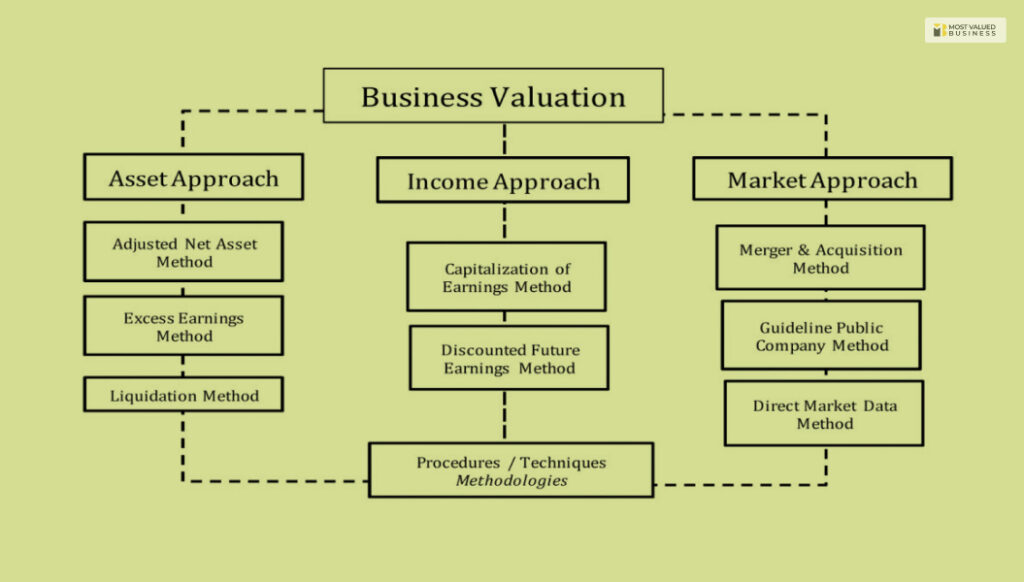

However, the tools that are used to do a company valuation may vary depending on the businesses, evaluators, and industries. The most general approaches include reviewing the financial statements, similar company comparisons, or discounting cash flow.

Company valuation also plays a vital part in tax reporting. The Internal Revenue Service (IRS) demands that businesses value depending on fair market value. Certain tax-based events like the purchase, sale, or gifting of shares are put to taxation depending on the company valuation.

Methods Of Company Valuation

There are many ways in which you can conduct a company valuation. You will get to learn about the most fruitful methods in the article below.

Market Capitalization

This is one of the easiest techniques of company valuation. Companies market capitalize by multiplying the share prices with the total outstanding shares.

For instance, company A’s individual share price in the market is $90 per share; the outstanding shares that count to 1000. Therefore the company then values at $90X1000= $90,000.

Times Revenue Method

Under the times revenue company valuation method, a stream of generating revenues over a given period applies to a multiplier that depends on the economic environment and the industry to which the company belongs.

For instance, a technical company may value at 3X revenue, whereas a service agency values at 0.5X revenue.

Earnings Multiplier

The earnings multiplier method is a more reliable method than the time revenue method as the valuation of a company solely depends on the profits that it is making and not the sales revenue that it is making.

The earnings multiplier adjusts any future profits against the cash flow that companies could invest at the present rate over the same time period. In simpler words, it helps in adjusting the present P/E ratio to account to get the current interest rates.

Discounted Cash Flow (DCF) Method

This method is indistinguishable from the profit multiplier method. This method operates on the projections of future cash flows, which then go through adjustments to get the current market value of the business.

The only difference between the profit multiplier method and the discounted cash flow method is that this method takes inflation into consideration while doing the company valuation.

Book Value

This is the value that is there on the balance sheet as shareholder’s equity in a business. You can derive the book value by subtracting total liabilities from the total assets in the company.

Liquidation Value

Liquidation is the value of the net cash that a company will generate if it were to sell off all its assets and payoff all the liabilities on a said day.

You must know this is not the only list of methods for company valuation. There are other valuation methods that you can easily use, like the break up value, replacement value, or asset-based valuation, among many others.

Company Valuation Formula

Just like the approaches, there is no particular formula that you can use in order to calculate the value of a company. However, there are certain formulas that are popular among analysts that conduct company valuation.

Asset Approach Formula

| Net Asset Value = Fair Value Of All The Assets That Are Owned By A Company – The Total Sum Of All The Outstanding Liabilities In A Company. |

P/S Ratio Formula

| Ps Ratio = Share Price/ Total Number Of Sales |

P/E Formula

| Pe Ratio = Stock Price/ Per Share Earnings |

Pbv Formula

| Pbv Ratio= Stock Price/ Book Value Of The Said Stock |

Ebitda Formula

| Ebitda To Sales Ratio = Ebitda/ Company’s Net Sales |

Company Valuation Examples

Let us consider that the PE ratio for a company ABC is 5. On the other hand, the share price of the company ABC is $100, and the per-share earnings are $40.

While the share price of company XYZ is $80, and per-share earnings are $10.

Therefore, the PE ratio for company ABC will be 2.5, i.e., 100/40. On the other hand, the PE ratio for company XYZ will be 8, i.e., 80/10.

This shows that company ABC has a lower PE ratio compared to company XYZ.

Hence, the undervalue company ABC will be a better buy for inventors. However, the company XYZ may not be a good buy because of its overvaluation.

Read More: Using An Enterprise Value: All That You Need To Know

Wrapping Up

Company valuation is an essential factor in calculating the financial health of a company.

Companies approach specialists that do the job for them.

If you own your own business, company valuation is something you must always consider as it is one of the most decisive steps that you can take for the betterment of the business.

Read Also: