Dog In Business: An Interesting BCG Matrix Business Model

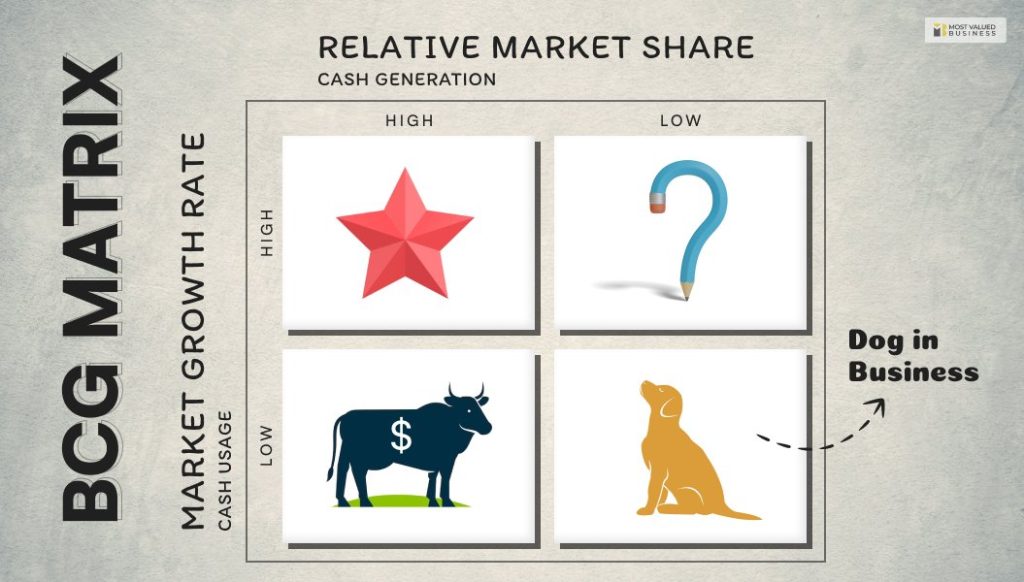

Dog in business is among the four categories in the BCG Matrix quadrants. It is among the four quadrants in the BCG growth matrix. A dog is a business unit that comprises a small market share.

Dog refers to that business unit of your company that will close soon. On one hand, the cash cows and stars are the biggest revenue generators. On the other hand, the question marks and cows consume resources. But they do not give any output.

The business unit categorized as question mark can be still saved by changing the business strategy or approach. However, the dogs are beyond saving.

How to categorize a dog?

This is a mature industry that generates neither strong cash flow nor will it also not require any hefty investments in the cash flow. The Cash cow or star is that category of business unit that is powerful enough to generate cash for the business for a longer duration of time.

Before tagging a business unit as dogs, you must explore all opportunities to save it. If your business unit is not generating revenues for a considerable time, it is shifted to the category of question marks.

After that, you will see if there is any chance of saving this unit. It depends on the brand to decide if they want to tag the unit as dogs or question marks. If you need a hefty investment to save the unit or make it operational again, it is naturally recognized as dogs.

What Is Dog In Business?

The term “dog” specifically refers to products or business units that have low market share in a market that is not experiencing significant growth. These products have limited potential and may not contribute significantly to the company’s overall profitability. In some cases, businesses may choose to divest or phase out “dog” products unless there are strategic reasons to continue their presence in the market.

How Can You Identify A Particular Business Falls In Dog Category?

Hmm!! I think this is a billion-dollar question: How do we identify a business that is falling in the dog category? Now, let’s know the trick to having a clear idea about this matter. Once you start to follow these processes, things will become easier for you.

1. Low Market Share

Dog category companies have a relatively small market share compared to their competitors. This means that they may not have a significant presence in the market and are struggling to capture a substantial portion of market demand.

Most of the time, when a company falls into a debt trap, then it automatically goes down to the dog category. You must follow the correct process that can make things easier for you to reach your goals with ease.

2. Low Or Negative Growth Rate

The market in which Dog category companies operate is not experiencing significant growth. This lack of market growth can limit the potential for these companies to expand their sales or customer base. You can work on valuation models to build your business growth.

Companies that fall in the dog category either start their journey as market followers or become dead. Due to the loss of demand for their products and services. If you follow their business life cycle, then you will understand that the chances of growth rate are in a declining mode.

3. Limited Profitability

Due to their low market share and the stagnant or declining market. Dog category companies often face challenges in generating substantial profits. They may struggle to compete effectively to achieve economies of scale.

Most of the time, these companies face the perfect competition. You must try to follow the right process that can make situations easier for you. BCG Matrix can offer you a clear vision of your company’s present status.

4. Cash Consumption

Dog businesses might require continuous investment to maintain their operations, as they may not generate enough cash flow from their operations. This could make a drain on resources for the company overall.

Eventually, chances are there that they will fall into a debt trap. This can increase the chances of a company becoming insolvent. You must ensure that the scope of errors needs to be as low as possible from your end. A once-stop shop can make things easier for you.

5. Competitive Disadvantage

Companies in the Dog category often face strong competition from other firms with higher market shares. Their products or services may not offer a competitive advantage, making it difficult to differentiate themselves in the market.

If you want to gain a competitive advantage, things can become easier for you. Try to follow the correct process that can make things lucid for you. Plan out the best options so that your company can grow at a faster pace.

6. Strategic Considerations

Dog category companies are often evaluated for potential divestiture or restructuring. The decision may be made to reduce investment in these businesses, sell them, or discontinue certain product lines to focus resources on more promising areas. Follow the rule of thumb if you face difficulty.

Try to make proper strategic considerations that can make things easier for you. Follow the right process that can assist you in reaching your needs with ease. Strategic considerations can help your business to grow at a faster pace.

7. Limited Strategic Importance

These companies or product lines may not play a critical role in the organization’s overall strategy. Management might view them as having limited strategic importance compared to other parts of the business.

Limited strategic importance can pull down a company in the dog stage of the BCG matrix quadrant. Try to follow the best process that can assist you in reaching your objectives with complete ease.

8. Cost Focus

To remain viable, Dog category companies may need to focus on cost control and efficiency improvements. Cost reduction measures may be implemented to offset the challenges posed by low market share and slow market growth.

You must focus on the cost of the company, whether it is increasing or degrading. If it degrades, then it is a clear sign that the company falls into the dog category. You should identify this fact from your end.

Some Burning Examples Of Dog Category Companies

There are several examples of the Dog category company that do not exist today but have a huge craze once upon a time. Some of the eminent names of these companies are as follows: –

- Lehman Brothers, whose net worth was $69.11 billion, went bankrupt on 15th September 2008.

- Washington Mutual, whose net value was $327.9 billion, went insolvent on 26th September 2008.

- Worldcom also became insolvent on 21st July 2002, worth 103.9 billion dollars.

- Pacific Electric & Gas became bankrupt due to added losses in its account year after year.

- General Motors became bankrupt on June 1st, 2009. The network of this company was $40 billion.

These are the top 5 companies that fall in the dog quadrant of the BCG matrix. Due to a lack of inaccuracy in their policies and planning, they suffer from this situation. Once a great person said, “ It is easy to become a king but difficult to retain the kingship”. This proverb fits in this quadrant of the dog category.

Is it the right time to dump your dog?

We all know what is a dog in marketing by now. But it is necessary to get rid of this business unit, as soon as it is tagged as a dog.

Experts are split about this one. Some of them say- Yes it is very important to get rid of the dog component of the business ASAP!

However, another group says it might be too soon to take such a decision. Your dog might not bring profit to you. However, it might help in sales of other profitable products. In that case, there is always a chance that you will get an opportunity to revive the business.

What would you do in such a situation?

You may shift roles of that business division. Treat it like a marketing unit.

For evidence, if you can make flyers but don’t get customers who want artistic designs, shift your business skill to marketing skills. Look out for customers who want you to design marketing flyers. Previously, you were trying to sell your graphic designing skill as a product. Now you are marketing others’ products through flyers.

Why A Company Becomes A Sick Company?

There are numerous reasons why a company becomes a sick company. You should know the core reasons to avoid making these mistakes while running your organization smoothly. Let’s find out the core reasons behind it.

1. Poor Financial Management

Ineffective financial management, including poor budgeting, financial planning, and cash flow management, can lead to financial distress. Mismanagement of funds and resources may result in liquidity problems and an inability to meet financial obligations. Additionally, raising too many funds from outside can increase the liability of your business in the long run.

2. Excessive Debt

Companies that take on excessive debt without the ability to service it may face financial difficulties. High-interest payments and an overwhelming debt burden can lead to financial distress and, in extreme cases, bankruptcy. If you are a startup company, then excessive debt can increase the chances of your financial burden. You must follow the right approach to reduce the debt as much as possible.

3. Declining Revenue & Sales

Declining revenue and sales can lead to a collapse of the company. A significant drop in sales and revenue can put a strain on a company’s financial health. Factors such as market changes, increased competition, or shifts in consumer preferences can contribute to declining sales. Keeping your company’s sales figures intact is the biggest challenge for most companies. You need to be more aware of the market situation to stay alert from the initial phases of your business.

4. Operational Inefficiencies

Inefficient operations, high production costs, and poor supply chain management can erode profit margins. Companies that fail to adapt to changing market conditions or optimize their operations may face financial challenges. Although operational inefficiencies can lead to insolvency of the business. The main reason behind this is the company cannot balance the demand and supply position of their business.

5. Market Changes & External Factors

External factors, such as economic downturns, changes in regulations, or shifts in the industry landscape, can impact a company’s financial health. Failure to adapt to these changes can lead to financial distress. Most of the time, external factors and the change in the market trend can lead to long-term problems for the business. Furthermore, you should follow the right solution that can build your business in the correct order.

6. Legal & Regulatory Issues

Companies facing legal challenges, such as lawsuits, regulatory fines, or compliance issues, may incur significant costs and damage their financial stability. Sometimes, companies suffer from legal challenges. This can lead to long-term losses sometimes. You need to be aware of this while avoiding these situations from your end.

7. Technological Obsolescence

Companies facing legal challenges, such as lawsuits, regulatory fines, or compliance issues, may incur significant costs and damage their financial stability. Most of the time, companies cannot be at par with technological advancement. It can lead to long-term losses for your company. You must think about the trend to build your business in the correct order.

How Can A Company Recover From Dog Quadrant To Stars Quadrant?

Now, it is also a billion-dollar question of how you can recover your company. From the dog quadrant of the BCG matrix to the Star quadrant. You need to get through the complete process to have a better idea of it. Once you follow the correct solution, things can become easier for you.

1. Product Innovation

Invest in research and development to enhance the product or service. Introduce new features, improvements, or innovations that differentiate the offering and meet the evolving needs of the market. You need to keep on changing with the product planning.

Only then can you keep up with the competition. Once you follow the right process, things can become easier for you in the long run. Product and service development can help you move from the Dog quadrant to the star quadrant.

2. Market Expansion

Identify opportunities to expand the market for the product or service. This could involve entering new geographic markets, targeting different customer segments, or exploring untapped market niches.

If you want to move to the Star Quadrant, then you must look for market expansion policies. This will enhance your chances for business growth to a great extent. Although it is easy to say but hard to apply, you still need to focus on it to stay alive in the competition.

3. Strategic Partnerships

Form partnerships with other companies to leverage their resources, expertise, or distribution channels. Collaborations can open new opportunities and increase the market reach of the product. Dog in business do not focus on strategic partnerships.

Strategic partnerships can lead to more efficient planning that can help your business grow in the long run. You can opt for more mergers and acquisitions to recover the financial health of the company in the long run.

4. Marketing & Branding

Implement effective marketing strategies to reposition the product in the market. This may involve rebranding, targeted advertising, and promotional campaigns to create awareness and generate interest. Dog in business suffer from strategy formulation.

Keep your branding strategy out of the crowd. It will help you to reach your objectives with complete ease. Ensure that you follow the correct process from your end. Without efficient marketing plans, your business cannot survive in the long run.

Analysis of dogs of Apple’s business

Before knowing about the dogs in Apple’s business, you must know about their star products too.

Apple’s iPhone was a star from the beginning. However, the macbook product is the market leader now. Cash cows give the highest sales to your brand. However, stars are the most popular among customers.

Around the world, people know Apple for their iPhone. However, the disruptive growth of macbook under Tim Cook’s leadership made it their cash cow. But what is a dog in marketing of Apple?

At the same time, iPads’ sales depleted. Only graphic designers and business executives use the iPad for select purposes. Hence the revenue that this division returns does not justify the expenses to maintain it.

You can question that Apple TV is an equally obsolete product! May be. However, the sales of Apple Tv and the net revenue generated by Apple TV is higher. At least it is enough to sustain the division.

Final Take Away

Hence, these are some of the core factors that you should keep in mind while your business falls in dog quadrant. Dog in business can become a star. Just need to follow the mentioned process with ease.

You can share your views and comments in our comment box. Share your views and comments with us. This will help us to know your take on this matter. Try to make your choices on the correct end.

Recovering from the “Dog” quadrant to the “Stars” quadrant requires a combination of strategic planning, operational improvements, and a commitment to innovation. It’s essential to regularly reassess the market, competition, and internal capabilities to adapt and stay ahead in a dynamic business environment.

For More Business Related Articles Click Below!!