How Much Is My Business Worth? – Here Is How To Calculate It

Unless you are operating in a monopolistic market, there is absolutely no way that yours is the only company with the highest business worth in the whole market. The fact that your business operates in a market where you will find competitors of all every range is something that must cause concern about the worth of your business.

Have you ever asked yourself, “How much is my business worth?”

If so, congratulations! You are quite serious about your business.

If not, then what are you doing? Do you honestly think you would succeed in a market with such a level of cut-throat competition where you are not even aware of your business value?

Whether you are a lender that is deciding if a business is a worthy investment or if you just want to know the worth of your business before you make a strategic exit, you must learn how to value trade with multiple business valuation methods.

In this article, I will be talking about the most effective ways in which your question,

“How much is my business worth?”

will eventually be answered.

So, without any further delay, let us just get into the depths of business valuation.

What Is Company Valuation?

Essentially, business value is the process of determining the real value of a business or enterprise.

For instance, if a new entrepreneur is planning on selling his business to begin a new project, creating business value for the company is a must because only then will the entrepreneur be able to ask for a reasonable price for his brand, resources, and other elements.

Just like that, an investor may want to value a business to know whether it will be profitable and, accordingly, how much it should offer to the owner to purchase the business.

Therefore, the question in your mind should not just be,

“How much is my business worth?”

It should also be

“How much is the worth of a business for me to invest in?”

However, the common topic in the matter is business worth. If you do not know how to calculate the worth of a business, it would be impossible for you to evaluate the worth of it properly.

So, let us now see what are the best methods to evaluate the value of a business.

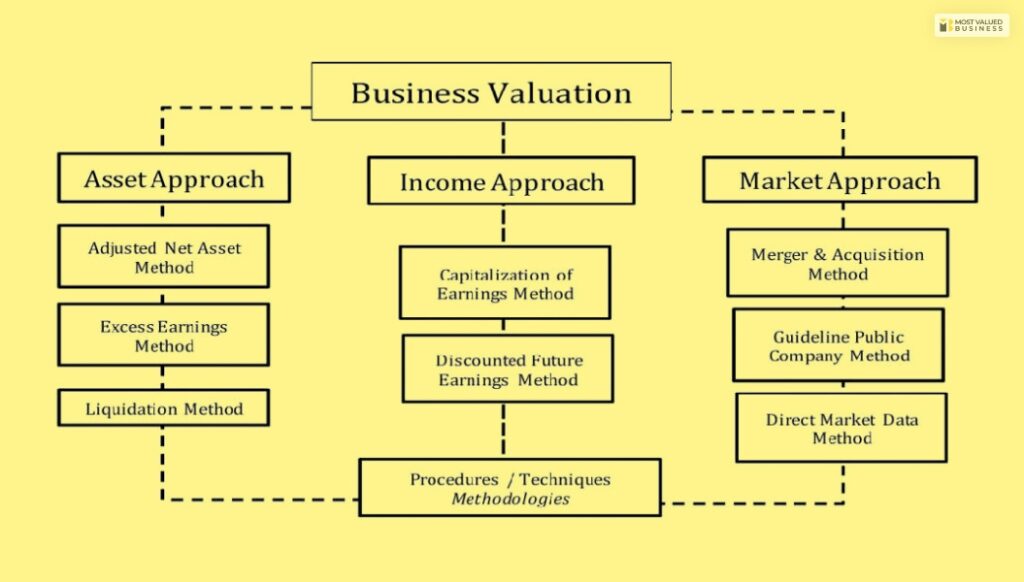

Business Value Calculation Methods

Here are the most effective methods of evaluating a business, be it for your own business or the business of someone else.

Book Value

In easy words, the book value of the company is its value on paper, the value of the company on the balance sheet.

Inspecting the book value is an easy and quicker way to evaluate the worth or value of a business. However, the simplicity of this method is what makes it pretty unreliable.

Calculating the book value of a business is easy; all you need to do is subtract the value of liabilities from the value of its assets. This will help you to calculate the value of the owner’s equity. You are then supposed to eliminate the intangible assets that the company owns. You are therefore left with the actual tangible asset value of the company.

Discounted Cash Flow Analysis

The discounted cash flow method is another way in which you can do the business evaluation of a company. This process of valuation involves assessing the value of a business based on the apparent cash flow that is supposed to be generated by the organization in the future.

The discounted cash flow method uses the company’s current cash flow and other related factors to determine the future value of a company.

The formula for the discounted cash flow analysis is:

| Discounted Cash Flow: Terminal Cash Flow/ [1+ Cost of Capital]# of Years in the Future |

Enterprise Value

This is yet another method by which you can compute the business value of a brand. To establish the business value, you would need to combine the equity of the company with its debts and then minus the cash that is not put to use for funding its operations, which necessarily means free cash.

Here is the formula which will help you get a more detailed picture of the same:

| Enterprise Value: Debt + Equity – Cash |

Market Capitalization

Market capitalization or market cap is an easy and valuable way through which you can establish the value of a publicly traded company. Market evaluation can be done by multiplying the total shares of the company with the current rate of each share.

The formula for market capitalization is:

| Market Capitalization= Total number of shares X Price of each share |

Therefore, if a business has a total of 10,000 shares where the share price for each share is $50, the market capitalization for that company would be $500,000.

Market cap is a very effective way of business valuation; however, it is only significant for the value of a business’s equity. This may cause a problem if you are doing a comprehensive analysis, as the financial source for most businesses is equity and debt, which includes loans, angel investments, etc.

P/E Ratio

The price to earnings or the P/E ratio is a valuation method that is used to measure the present share price of a company to its EPS, or earnings per share.

This method is also popularized as the price multiple or the earnings multiple. The P/E ratio allows you to measure how valuable the shares of a company are in relation to its real-world or raw value.

Therefore, it is the perfect way to evaluate a company that is publicly traded as an investor in the stock market.

Small business owners also use the P/E ratio that demand a high selling price from probable buyers for their business.

The formula for the P/E ratio is:

| P/E Ratio = Market value of each share/ Earning per share |

You would need to divide the market value of a company’s shares by the definite earnings that those shares represent.

By doing this, you can easily determine if a company is potentially overvalued or undervalued in the stock market.

The Bottom Line

Lastly, I’d like to add that these methods aren’t the only limitations that you can use to value your business. There are other ways too that you can refer to. It depends on the type of your business and the industry you are operating in.

However, the basic question of “how much is my business worth?” should is clear by now.

Business valuation is a crucial factor for not only deciding the worth of your business but also for deciding if a business is worth your investment.

Read Also: